Chapter Twenty

Michael Shannon

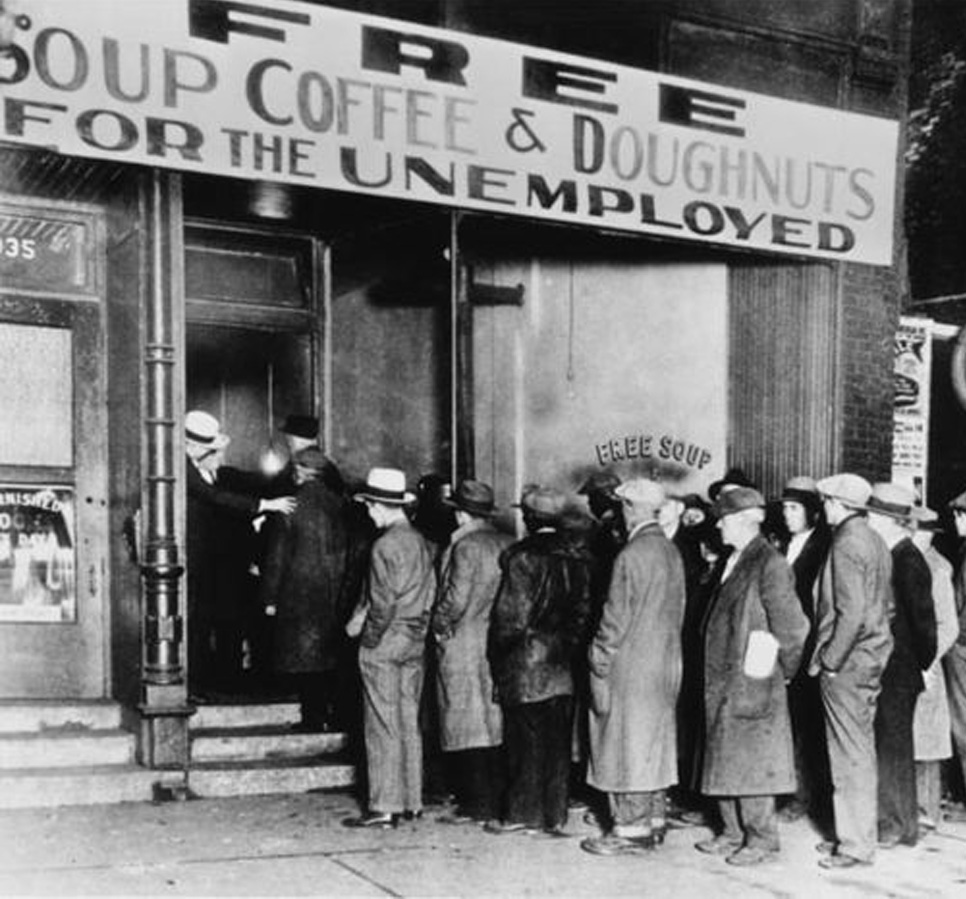

The Great Depression was a severe global economic downturn that lasted from 1929 to 1939. The period was characterized by high rates of unemployment and poverty. Everywhere. It was the first major indication that depressions was not just something that happened to the USA but were in fact global. America began a chain reaction that affected every industrialized countriy on Earth.

My grandmother Eileen belonged to the book of the Month club for decades and some of my first adult books came from her library. Though she had only a sixth grade education she was a voracious reader. The book I borrowed in 1958 was “Out of Africa.”

The Colony and Protectorate of Kenya, commonly known as British Kenya or British East Africa, was a colonial possession of the British Empire located in East Africa. Americans for the most part are unfamiliar with the country unless they’ve seen the film “Out of Africa” loosely based on a memoir by Karen Dinensen (Blixen)* about her time as a coffee planter during the depression. Heavily fictionalized the story does demonstrate the connections between powerful nations who were unable to adapt to the new reality of the international collapse of trade in general and for the Dinensen plantation, coffee in particular.

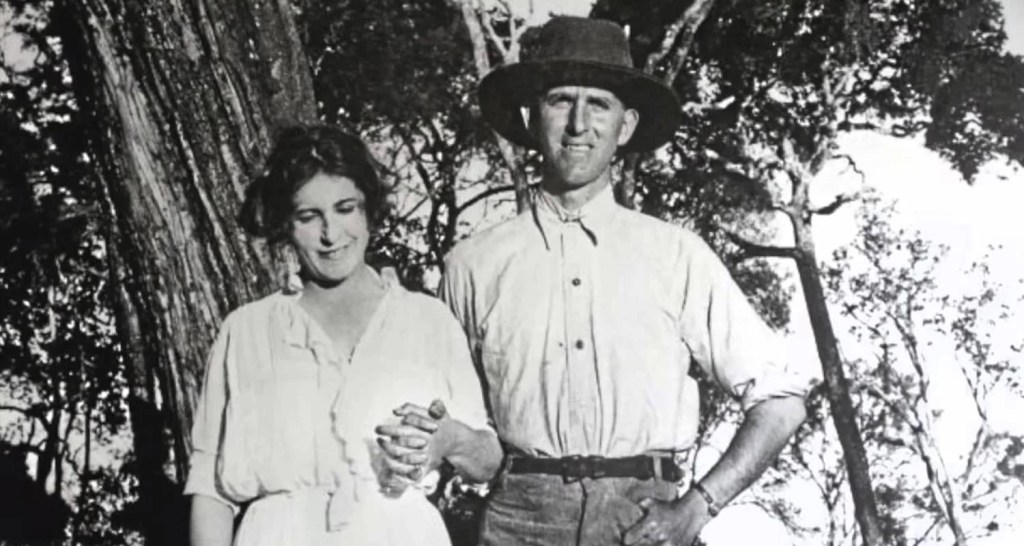

Karen Dinensen Blixen and Denys Fitch Hatton, 1917′

Beginning with the end of the first World War** when the triumphant victors stopped spending like drunken sailors and begin to realize that the monumental debt they had incurred needed to be paid for somehow.

Instead of a dedicated policy to address the problem President Wilson and his advisors simply decided that markets would stabilize on their own and took a Leissez Faire approach. The immediate cancellation of war contracts struck at the heart of the American economic system particularly farmers who lost most of their markets.

My paternal grandfather Jack Shannon and most of the farming and ranching families in our county who had supplied beans and peas for the war effort had to abandon their crops for which suddenly, there was no market. For my grandfather, it spelled the end of his farming operations and forced him to find another use for the land. Things got very tight very fast. From the late ‘teens until Hitler brought him another war the family lived on the edge financially.

Grandpa Bruce and Signal Oil faced the same financial monster. Too much production and shrinking markets. Surviving banks, thousands of U.S. banks disappeared between 1929 and 1932, with 2,293 failing in 1932 alone were hit by falling incomes, mortgage defaults, especially rural, business failures, and general economic collapse weakened banks and millions lost their life savings. Personal savings were erased as if they never existed.

“Once I built a railroad, made it run / Made it race against time, Brother, can you spare a Dime?”***

As you know from previous chapters of The Twelve Hour Tour, Bruce lost his job with Barnsdall Oil, they could not qualify for Relief because he owned a car, the family had to move in with his brother’s family and when he did get another job this time with Signal Oil in 1933, he had his wages cut in half. “Half of something is better than all of nothing though,” He said, and he went back to the Twelve Hour Tour.

The Halls were living the worst financial depression in our history. As people moved through the 1920’s interest rates were kept low to make money cheap and encourage people to borrow. There was a housing boom and construction was in high gear all across the country. There is an old Wall Street “Saw” that when skirts go up so does the market, times are good. They did too. Skirts went way up, silk stockings and Jazzin’ babies. FitzGerald wrote about it and it made him famous. He also wrote the cautionary tale of Jay Gatsby and its cynical attitude towards the American Dream. He drew the future but no one listened. American finance ran right of the cliff.

The The Smoot-Hawley Tariff Act of 1930 was a U.S. law that drastically raised tariffs on over 20,000 imported goods to protect American farmers and businesses during the Great Depression. Not surprisingly it triggered retaliatory tariffs from other nations, causing a collapse in global trade, worsening the Depression, and becoming a symbol of disastrous protectionist policies. The act significantly increased import duties, leading to a global trade war and a roughly 66% drop in world trade between 1929 and 1934, demonstrating the dangers of such economic nationalism.****

That was the darkest side. There wasn’t much light if you were a working man with a family. By the summer of 1933, Bruce and Eileen had a new baby girl, Patricia, Bob who was 13, my mother, who had just turned fifteen and the oldest Mariel who was sixteen. Like most they were a single income family.

Struggling in hard times is pretty personal. There is little time to ponder world events even though they affect you because the imperative is just to figure out how to survive them. Depending on your perspective the farmer had been struggling since the end of the war. They were ten years in. Manufacturing , including the oil business continued to prosper. Smaller companies without financial reserves did fall by the wayside but individual spending by those who could just seemed to get better and better. It was the Jazz age, until it wasn’t.

In The Glory and the Dream: A Narrative History of America, 1932-1972, author and historian William Manchester argued that Herbert Hoover deliberately chose to use the word “depression” when discussing the economic situation of the time. Similar economic downturns in American history had been referred to as panics or crises but the Hoover White House decided, and continually referred to the financial slide as depression. Hoover believed that the word depression sounded less alarming. History shows that any efforts they took to slow the economic crises were in vain and did little to reassure the public. At the beginning stages of the Great Depression, Hoover remained in a state of denial over worsening economic conditions. Shortly following Black Tuesday, Hoover remarked that the “conditions are fundamentally sound.” Even as late as December 1930, Hoover maintained that “the fundamental strength of the economy is unimpaired.” It was not until 1931, when it became impossible to deny the economic train wreck transpiring, that Hoover began to refer to the economic situation of his own time as a “great depression.”

Herbert Hoover’s famous slogan was “A chicken in every pot and a car in every garage,” which he used in his successful 1928 presidential campaign promised prosperity, though it became ironic after the 1929 crash. In his 1932 re-election campaign, facing economic ruin, his slogans shifted to defending his limited government approach against FDR’s activism, emphasizing “ordered liberty” versus “new deal” government. Opponents hung the phrase, “Hoover, we trusted—now we’re busted”.

My father, a very sharp man could distill problems to a single phrase, something he did often. The fundamental cause of the Great Depression in the United States was a decline in spending, which led to a decline in production as manufacturers and merchandisers saw an unintended rise in inventories. The sources of the contraction in spending in the United States varied over the course of the Depression, but they cumulated in a monumental decline in demand. My Dad said, “People had money but they wouldn’t spend it because they had lost faith in the government’s ability to respond to the crisis.” He said, “It became a point of pride to be frugal.” Something I learned about at our kitchen table, instilled in his children by his personal action. A not uncommon trait in the adults we all grew up with.

Signal was on the edge of bankruptcy. One of Mosher’s company goals was an attempt to streamline the organization and to adapt quickly to new technologies in order to reduce the cost of operations. The big boys like Standard played the independents off against one another. If Signal could not meet the price and volume dictated by the far larger company somebody else would.

A key factor wa the fact that contracts were paid out on monthly, bi-monthly or other timelines that favored the buyer. For example if Standard of California contracted to buy from an independent the price agreed on would be budgeted by the accounting department and paid after delivery. If SOCAL was late on payment or decided for some reason to crush an independent they could. The money set to be disbursed was always a month or more behind delivery of the oil so if the little guy failed they still had ample funds to buy from someone else. Big companies actively looked for aggressive suppliers who they believed would not be able to deliver the amount contracted or do it on time. There was always a strapped supplier who would take a chance in order to stay alive. The big companies were predatory and showed no mercy. As my father once said, “If you get into business with the big guys you are going to get more than a good nights sleep.”

So it was. Sam Mosher and his “Varsity” team, a nice turn of phrase meant to convey confidence in men who were expected to be unconventional and aggressive in seeing to the health of the small outfit that was Signal. Wells that were underperforming or “Wildcats” that had never reached oil sands, small operators trying to unload underperforming debt were all meat for Signal. Sharp geologists who could see something in core samples or location that gave some promise of oil turned over reports to Signals Landmen who slipped right in and bought up the land leases for underperforming or dry holes for pennies on the dollar.

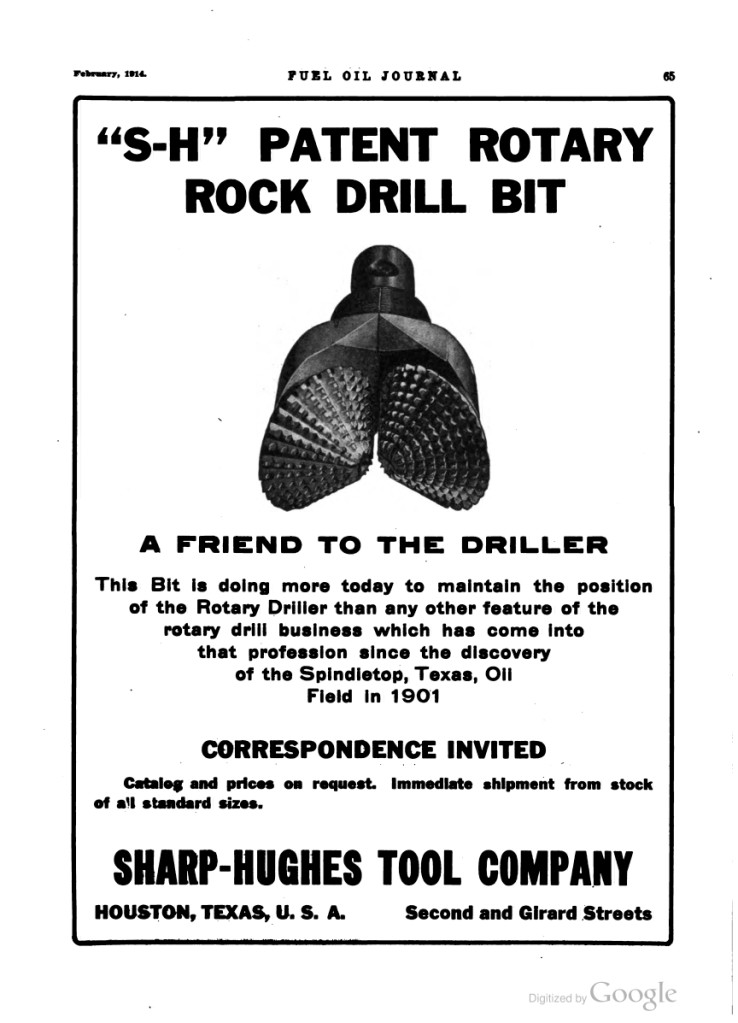

Bruce’s great value was his innate sense of direction; something inherent to the basic nature of the man, something originating from the mind rather than experience. It informed ability to whipstock and read a well. In the early thirties much of the modern equipment you see today had not been developed. The Hughes Tool Company’s two cone rotary bit was developed in 1909 and had revolutionized drilling. In 1930 Hughes also began marketing the so-called “Christmas Tree” a system of valves designed to control the flow of wells. That ended the day of the gusher, the uncontrolled blow out that did so much damage to operations. Though they look spectacular in old photos and in movies, they did terrible damage. Entire casing runs were blown out of wells, drill rigs were destroyed. They often caught fire or simply blew up because of the gas content.Hhundreds of thousands of barrels of oil just ran onto the ground. Bruce said that if a tool pusher let a well get away he was likely to lose his job. With too many men and not enough jobs he would likely be finished for good.

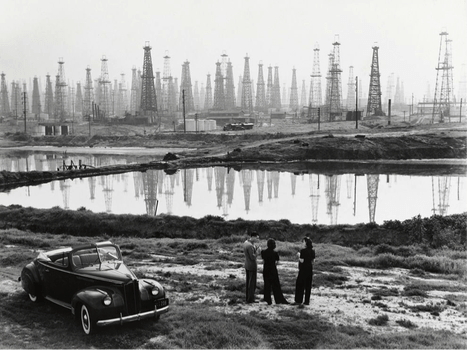

Signal Hill oil sumps, Long Beach California.

Legal theory determined that every lease be contained within the confines of it’s surface dimensions. This mean that as the drill string moved deeper into the earth it had to stay within it’s contracted boundaries. Oilmen said simply “legal-schmegal “and let their bits wander or better yet they had men like Bruce Hall who could wield a whipstock inserted in the casing to send the bit and its string meandering like a blind worm. At the once quiet and empty Ellwood bluffs were now a hub of activity, 24 hours a day. Long accepted rules of conservation in a new oil discovery were thrown out the window. It was a case of “get the oil out of the ground before your neighbor beats you to it”. New roads, buildings, vehicles, machinery and storage tanks were popping up every day. New technology was constantly being introduced to increase the output. Obviously, aesthetics was not a concern.

The piers at Ellwood crept farther and farther out into the Santa Barbara channel following the slant drilling rigs. There were no instruments to track the location of the bits, it was all done by guess and by gosh. Those like my grandfather who could simply touch and listen were highly valued. They didn’t speak of piracy but they certainly were that. An inspector could measure the amount of pipe tripping in and out of the hole but there was no way to know exactly where it was going.

Long Beach was the same, drill streams were snaking out under Ocean Boulevard towards the Pacific. Even though the Oil business was strangling on itself by over producing the operators just could not stop.

With three teenagers and a new baby up in Hope Ranch the Halls seemed to be on an upswing in their fortunes. They were about to make some decisions about their itinerant lives that would have a profound impact on the lives of their kids.

Next, Chapter 21

High School

Cover: Thomas Hart Benton painting, “Boomtown” Borger, Texas 1928

*It is a pity that Hollywood got her deliberately wrong. One must wonder what this woman, who spent her life writing and wondering about the role of fate in controlling human lives, would have thought of that throw of the dice? Karen loved telling stories in her low, husky voice and would do so at any opportunity. In 1952 her book Out of Africa lost the Nobel Prize to Ernest Hemingway. “I would have been happy, happier, today if the prize had been given to that beautiful writer, Isak Dinesen.”

– Ernest Hemingway

**World War One was hardly the first instance of a world war, the Hundred years war, The Seven years war, the muslin conquest of most of the so-called civilized world and even Tamir, Ghengis Khan and the Emperor Babu head of the Mughal Empire would all qualify as World Warriors.

**”Brother, can you spare a dime?” Written by Yip Harburg who was working as a lyricist and the melody which derives from a Jewish lullaby that the composer Jay Gorney heard as a child in Russia. The song has been covered by at least 52 artists in the United States including Bing Crosby, Al Jolson, Rudy Valee, Judy Collins and Tom Waits. Click link to listen: https://www.youtube.com/watch?v=63OBM3kuejc

****Something we should have learned from.

Michael Shannon lives and writes in Arroyo Grande, California.